|

|

马上注册,结交更多好友,享用更多功能,让你轻松玩转社区。

您需要 登录 才可以下载或查看,没有账号?注册

×

作者:微信文章

走向大师说

Exam56物流货运代理网专注于国际货运代理、物流行业的深度研究和专项考试分析,帮助小伙伴提升行业的认知和积累。

在美国和中国意外宣布暂停90天关税之后,航运公司正忙碌地为跨太平洋货物需求的突然激增做准备。这一变化引发了市场对运力短缺和即期运价上涨的担忧。

此次关税调整是在没有任何预警的情况下公布的,美国对中国进口商品的关税从145%大幅降至30%,而中国则将关税从125%降至10%。

据海洋情报局在一份最新分析中指出,尽管关税的调整在一定程度上缓解了贸易压力,但航运公司在过去四周已经削减了运力,以应对过去一个月预订量的下降。如今,随着关税暂停,他们不得不在8月14日的截止日期之前争分夺秒地增加运营。

海洋情报公司的首席执行官艾伦·墨菲表示:“航运公司需要迅速提高运力,以适应预期的订单激增。”他进一步指出:“为了在8月14日新的截止日期之前将货物运往美国,旺季货物必须不迟于7月中旬装运。”

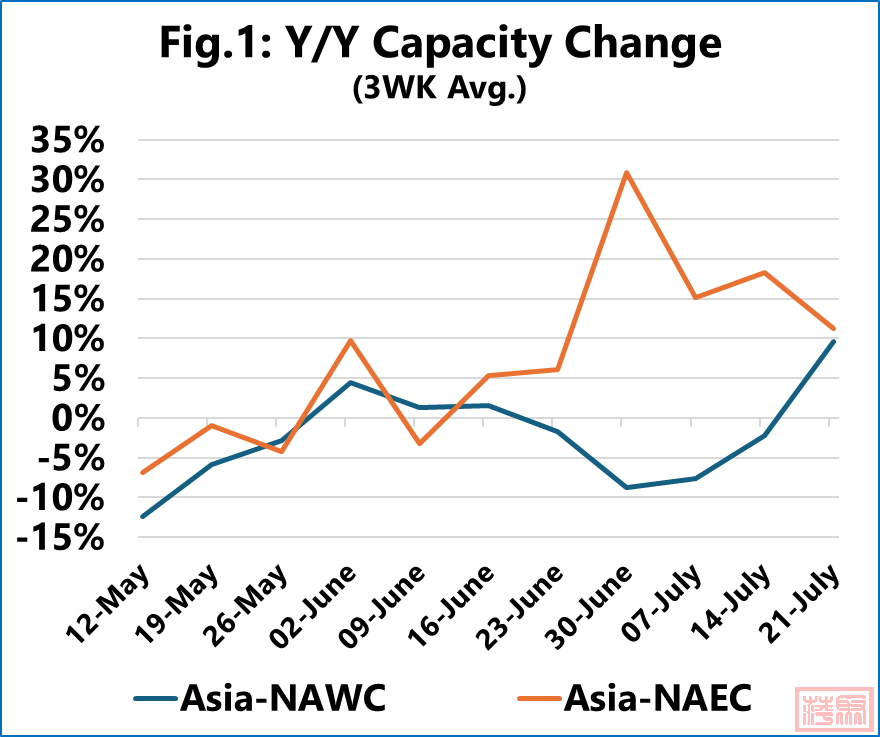

然而,最近的分析发现,运力的注入仍然有限,尤其是在北美西海岸的贸易通道上,尚未观察到有意义的增长。相比之下,东海岸则出现了运力增长的早期迹象,尽管仍落后于计划。

墨菲指出:“西海岸的运力仅从7月中旬开始出现有意义的增长,而东海岸则从6月底开始运力大幅增长。”但他同时警告说:“如果来自中国的货物即将激增,那么增加运力可能已经为时已晚。”

这家丹麦集装箱航运研究公司还表示,这种延迟的反应可能会导致即期运价大幅上涨,并迫使承运人从其他亚洲出口贸易中重新分配船只,从而可能扰乱更广泛的航运网络。

由于旺季货物需要在7月中旬前运输,以满足关税截止日期,行业分析师警告称,未来几周内,空白航班和设备短缺可能会进一步复杂化供应链的稳定性。

墨菲表示:“这可能会导致现货价格大幅上涨,以及更多的运力进入跨太平洋航线,而牺牲了其他亚洲出口贸易的空白航线。”

Shipping lines are bracing for a sudden surge in Transpacific cargo demand following the unexpected 90-day tariff pause between the United States and China, raising concerns over capacity shortages and rising spot rates.

The tariff agreement, announced without prior warning, reduces U.S. duties on Chinese imports from 145% to a baseline 30%, while China has lowered its tariffs from 125% to 10%.

Sea-Intelligence said in a new analysis that despite the partial relief, carriers had already cut capacity over the past four weeks in response to declining bookings over the past month, leaving them scrambling to ramp up operations before the August 14 cut-off.

"Shipping lines need to ramp capacity up quickly to accommodate an expected surge in bookings," said Alan Murphy, CEO of Sea-Intelligence.

"Getting cargo into the U.S. before the new August 14 cut-off requires peak season cargo to be shipped no later than mid-July."

The recent analysis found that capacity injections remain limited, particularly on the North America West Coast trade lane, where no meaningful increase has been observed. In contrast, the East Coast is seeing early signs of capacity growth, though it remains behind schedule.

"The West Coast only sees a meaningful increase from mid-July, whereas the East Coast sees significant capacity growth from end-June," Murphy noted. "But this is still very late for a capacity increase if there is an imminent surge of cargo from China."

The Danish container shipping research firm said the delayed response could lead to sharp spot rate increases and force carriers to reallocate vessels from other Asian export trades, potentially disrupting broader shipping networks.

With peak season cargo needing to move by mid-July to meet the tariff deadline, industry analysts warn that blank sailings and equipment shortages could further complicate supply chain stability in the coming weeks.

"This could lead to a sharp rise in spot rates, as well as much more capacity insertion into the Transpacific, at the expense of blank sailings in other Asian export trades," Murphy said.

|

|